Delve into the intricate world of term life insurance rates, where various factors come into play to determine the premiums you pay. From age to health conditions, this guide will navigate you through the essentials of securing the best rates for your needs.

Explore the different types of term life insurance, strategies to lower your rates, and how to effectively compare rates from various providers. Get ready to make informed decisions about your financial future with this in-depth exploration.

Factors Affecting Term Life Insurance Rates

When it comes to determining term life insurance rates, several factors come into play. These factors can impact the premiums you pay for coverage and are essential to consider when choosing a policy.

Age

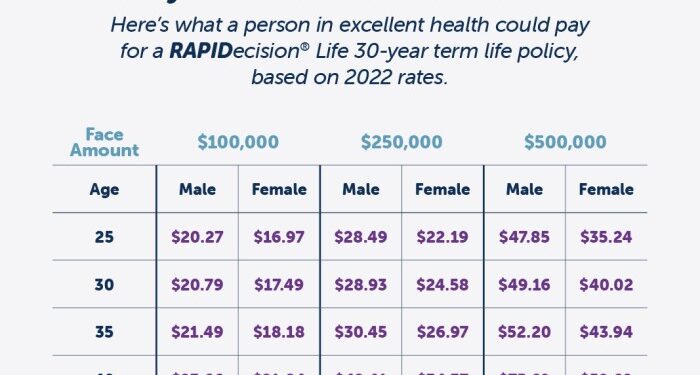

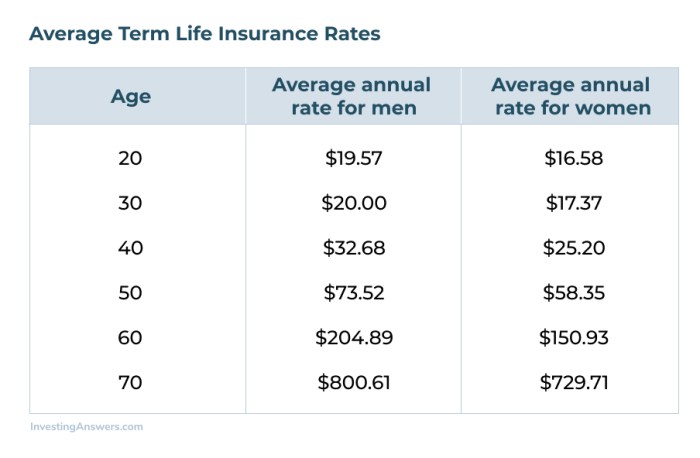

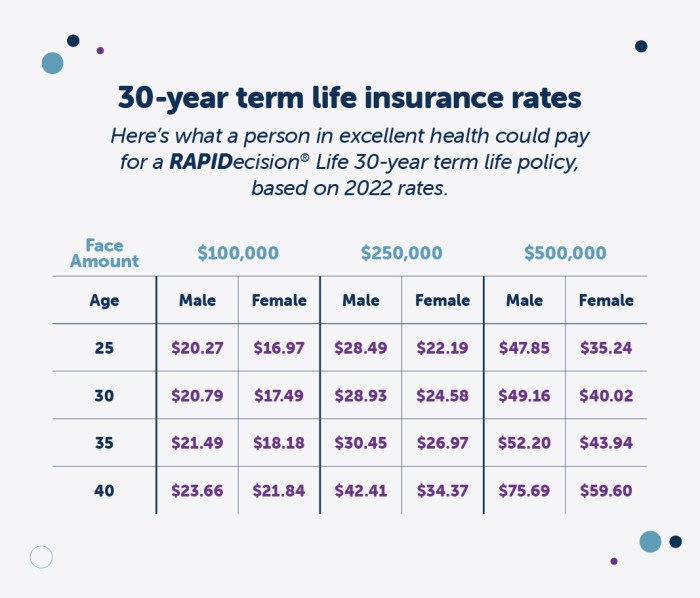

Age is a significant factor that influences term life insurance rates. Generally, younger individuals pay lower premiums compared to older individuals. This is because younger people are considered less risky to insure as they are statistically less likely to pass away during the term of the policy.

Health Conditions

Your current health condition also plays a crucial role in determining your term life insurance premiums. Individuals with pre-existing health conditions may face higher rates or even be denied coverage altogether. Insurance companies assess your health through medical exams and health questionnaires to determine the level of risk you pose.

Gender, Occupation, and Lifestyle

Other factors that can affect term life insurance rates include gender, occupation, and lifestyle choices. Women typically pay lower premiums than men, and individuals with risky occupations or hobbies may face higher rates due to the increased likelihood of accidents or health issues.

Coverage Amount and Term Length

The coverage amount and term length you choose can also impact your term life insurance rates. Opting for a higher coverage amount or a longer term length will generally result in higher premiums. It's essential to strike a balance between the coverage you need and what you can afford in terms of premiums.

Types of Term Life Insurance

When it comes to term life insurance, there are several types available in the market to cater to different needs and preferences. Understanding the differences between these types can help individuals make an informed decision when choosing the right policy for themselves and their loved ones.

Level Term Life Insurance

Level term life insurance is one of the most common types of term life insurance. With this type of policy, the death benefit remains the same throughout the term of the policy. Premiums also remain fixed, providing a predictable cost structure for the insured.

This type of policy is ideal for individuals looking for stable coverage and predictable premiums over a specific period, such as 10, 20, or 30 years.

Decreasing Term Life Insurance

Decreasing term life insurance is another type where the death benefit decreases over time. This type of policy is often chosen to cover specific financial obligations that decrease over time, such as a mortgage or other loans. Premiums for decreasing term life insurance are generally lower compared to level term policies since the coverage amount decreases over the policy term.

Renewable Term Life Insurance

Renewable term life insurance allows policyholders to renew their coverage at the end of each term without undergoing a medical exam. While premiums may increase with each renewal, this type of policy offers flexibility and peace of mind knowing that coverage can be extended without proving insurability.

Renewable term life insurance is suitable for individuals who may need coverage for an indefinite period or those who want the option to extend their coverage without hassle.The type of term life insurance chosen can significantly impact premium rates. Level term policies generally have higher premiums compared to decreasing term policies due to the fixed coverage amount.

Renewable term policies may start with lower premiums but can increase over time with each renewal. Understanding the differences between these types of term life insurance and how they affect premium rates can help individuals make an informed decision based on their specific needs and financial situation.

Ways to Lower Term Life Insurance Rates

Maintaining affordable term life insurance rates is crucial for policyholders looking to protect their loved ones without breaking the bank. There are several strategies individuals can implement to lower their premiums and secure the coverage they need.

Healthy Lifestyle Habits

One of the most effective ways to reduce term life insurance rates is by adopting a healthy lifestyle. Insurance companies often offer lower premiums to individuals who maintain a healthy weight, exercise regularly, avoid smoking, and have no serious health conditions

By prioritizing health and wellness, policyholders can not only improve their quality of life but also save on insurance costs.

Combine Policies or Choose a Shorter Term

Another way to lower term life insurance rates is by combining policies or choosing a shorter term. By bundling multiple insurance policies with the same provider, individuals may qualify for discounts or reduced rates. Additionally, opting for a shorter term length can result in lower premiums since the coverage period is shorter, reducing the overall risk for the insurance company.

Improve Credit Score

Improving credit score can have a positive impact on term life insurance rates. Insurance companies often take credit history into account when determining premiums, as individuals with higher credit scores are seen as more financially responsible and less risky to insure.

By maintaining good credit and managing finances wisely, policyholders can potentially secure lower insurance rates.

Comparing Term Life Insurance Rates

When comparing term life insurance rates from different providers, it is important to consider several key factors to ensure an accurate comparison and make an informed decision. Reading the fine print and understanding the terms and conditions is crucial to avoid any surprises in the future.

There are also online tools and resources available to help you compare term life insurance rates effectively.

Key Factors to Consider When Comparing Rates

- Policy Coverage: Make sure you are comparing similar coverage amounts and terms to get an accurate comparison.

- Age and Health Factors: Your age, health condition, and lifestyle choices can significantly impact the rates offered by different insurance providers.

- Term Length: The length of the term can affect the rates, so make sure you are comparing rates for the same term duration.

- Renewability: Check if the policy is renewable and if there are any changes in rates upon renewal.

Reading the Fine Print and Understanding Terms

- Take the time to carefully read through the policy details, including any exclusions, limitations, and conditions.

- Understand how premiums may change over time and what factors can impact the rates.

- Be aware of any additional fees, such as administrative charges or policy fees, that may affect the overall cost.

Online Tools and Resources

- Insurance Comparison Websites: Websites like Policygenius, NerdWallet, and Insure.com allow you to compare rates from multiple insurance providers in one place.

- Insurance Calculators: Use online insurance calculators to estimate the cost of term life insurance based on your age, coverage needs, and other factors.

- Insurance Company Websites: Visit the websites of different insurance companies to get quotes and compare rates directly.

Final Wrap-Up

In conclusion, understanding term life insurance rates is crucial in making the right choice for your financial security. By grasping the factors that influence rates, exploring the types of insurance available, and learning how to lower your premiums, you are empowered to protect your loved ones effectively.

Take charge of your future today with the knowledge gained from this guide.

Clarifying Questions

How does age affect term life insurance rates?

Age plays a significant role in determining term life insurance rates, with younger individuals typically securing lower premiums compared to older individuals.

Can health conditions impact term life insurance premiums?

Yes, health conditions can affect premiums, as individuals with pre-existing conditions may face higher rates or even challenges in securing coverage.

Are there ways to lower term life insurance rates?

Policyholders can lower their rates by maintaining a healthy lifestyle, combining policies, choosing shorter terms, or working on improving their credit score.

How can one effectively compare term life insurance rates?

Comparing rates involves looking at key factors like coverage amount, term length, and provider reputation. Online tools and resources can aid in this process.