Exploring the world of term life insurance quote opens up a realm of possibilities for individuals seeking financial security and peace of mind. This guide delves into the intricacies of term life insurance, shedding light on its significance and benefits in a concise yet informative manner.

As we navigate through the various aspects of term life insurance, readers will gain a deeper understanding of how to make informed decisions when choosing the right policy for their needs.

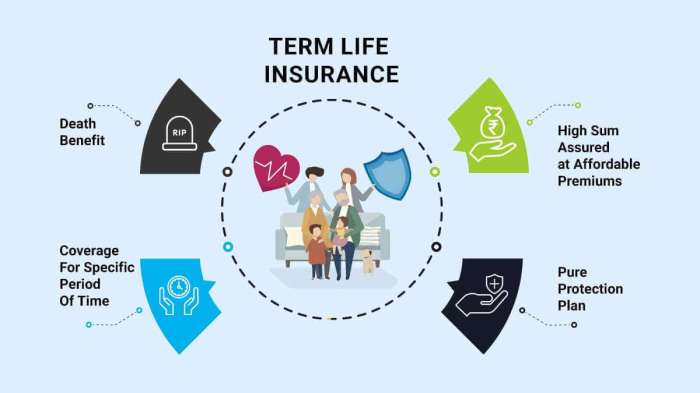

What is Term Life Insurance?

Term life insurance is a type of life insurance that provides coverage for a specific period, typically ranging from 10 to 30 years. Unlike whole life insurance or universal life insurance, which provide coverage for the insured's entire life, term life insurance only covers the insured for the specified term.

Key Differences

- Duration: Term life insurance has a specific term, while whole life insurance provides coverage for the insured's entire life.

- Premiums: Term life insurance premiums are typically lower than whole life insurance premiums.

- Cash Value: Term life insurance does not accumulate cash value like whole life insurance policies.

Typical Duration

Term life insurance policies typically range from 10 to 30 years, allowing individuals to choose a term that aligns with their financial obligations and coverage needs. The most common terms are 10, 20, and 30 years, providing coverage during critical periods of financial responsibility, such as paying off a mortgage or supporting children until they are independent.

Reasons for Choosing Term Life Insurance

- Affordability: Term life insurance generally offers lower premiums compared to whole life insurance, making it a more budget-friendly option for many individuals.

- Specific Needs: Term life insurance can be tailored to cover specific financial obligations, such as a mortgage or children's education, without the need for lifelong coverage.

- Flexibility: Term life insurance allows individuals to choose coverage for a specific period, providing flexibility as financial needs change over time.

Factors Affecting Term Life Insurance Quotes

When it comes to determining the cost of a term life insurance policy, several key factors come into play. These factors can greatly influence the premium you will pay for your coverage. Let's delve into the main considerations that impact term life insurance quotes.

Age and Health

Age and health are two critical factors that significantly affect the cost of a term life insurance policy. Generally, the younger and healthier you are when you purchase a policy, the lower your premiums will be. This is because younger individuals are considered less risky to insure and are less likely to develop health issues that could lead to a claim.

On the other hand, older individuals or those with pre-existing medical conditions may face higher premiums due to the increased risk they pose to the insurance company.

Coverage Amount and Term Length

The coverage amount and the term length you choose also play a crucial role in determining your term life insurance quote. Typically, the higher the coverage amount you select, the more you will pay in premiums. Similarly, opting for a longer term length can result in higher premiums compared to a shorter policy term.

It's essential to strike a balance between the coverage amount and the term length that meets your needs while also staying within your budget.

Lifestyle Choices

Your lifestyle choices can impact the cost of your term life insurance policy. Factors such as smoking, engaging in high-risk activities, or having a hazardous occupation can lead to higher premiums. Insurance companies assess these lifestyle choices to evaluate the level of risk you present as an insured individual.

Making healthier lifestyle choices and avoiding risky behaviors can help you secure a more affordable term life insurance quote.

Obtaining Term Life Insurance Quotes

When it comes to getting a term life insurance quote, there are a few key steps to keep in mind. It's important to provide accurate information, as this will directly impact the quote you receive. Additionally, undergoing a medical exam may be necessary to determine the final quote.

Here are some tips on how to navigate the process and compare quotes effectively.

Providing Accurate Information

It is crucial to provide accurate information when requesting a term life insurance quote. Insurance providers use this information to assess your risk level and determine the appropriate premium for your policy. Inaccurate information could lead to incorrect quotes or even the denial of coverage in the future.

Be honest and thorough when filling out your application to ensure you receive an accurate quote.

Role of a Medical Exam

In some cases, insurance providers may require a medical exam as part of the underwriting process to determine your quote. The results of this exam, including your overall health and any pre-existing conditions, will impact the final premium you are quoted.

It is essential to be prepared for the exam and provide honest information to ensure an accurate assessment of your health status.

Comparing Quotes

When comparing term life insurance quotes from different providers, it's essential to consider more than just the price. Look at the coverage amount, term length, and any additional benefits or riders offered by each provider. Consider the financial stability and reputation of the insurance company as well.

Remember to compare quotes based on similar coverage to make an informed decision about which policy best suits your needs and budget.

Understanding Term Life Insurance Policy Options

Term life insurance policies offer a variety of options to cater to different needs and preferences. It is essential to understand the differences between these options to make an informed decision when choosing a policy.

Level Term, Decreasing Term, and Increasing Term Policies

- Level Term: In a level term policy, the death benefit remains the same throughout the policy term. This type of policy is suitable for individuals who want a consistent coverage amount.

- Decreasing Term: A decreasing term policy provides a death benefit that decreases over time. This type of policy is often chosen to cover specific financial obligations that decrease over time, such as a mortgage.

- Increasing Term: An increasing term policy offers a death benefit that increases over time. This type of policy is designed to keep up with inflation and rising expenses.

Riders and Add-Ons

- Accelerated Death Benefit Rider: This rider allows the policyholder to receive a portion of the death benefit if diagnosed with a terminal illness.

- Waiver of Premium Rider: With this rider, the insurance company waives the premium payments if the policyholder becomes disabled and is unable to work.

- Conversion Rider: This rider enables the policyholder to convert their term policy into a permanent life insurance policy without the need for a medical exam.

Choosing the Right Term Life Insurance Policy

When selecting a term life insurance policy, it is crucial to assess your individual needs and financial goals. Consider factors such as your age, health condition, financial obligations, and future plans. It is recommended to work with a knowledgeable insurance agent to help you navigate through the various policy options and choose the one that best fits your requirements.

Outcome Summary

In conclusion, term life insurance quote serves as a crucial tool in safeguarding one's future and ensuring the well-being of loved ones. By grasping the fundamentals Artikeld in this guide, individuals can confidently embark on the journey towards financial protection and stability.

Quick FAQs

What factors determine the cost of a term life insurance policy?

The cost of a term life insurance policy is influenced by factors such as age, health, coverage amount, and term length.

How can one obtain an accurate term life insurance quote?

To obtain an accurate quote, it is essential to provide precise and honest information when inquiring with insurance providers.

What are some common options available within term life insurance policies?

Term life insurance policies offer options like level term, decreasing term, and increasing term, each catering to different needs.

Do lifestyle choices impact the cost of term life insurance?

Yes, lifestyle choices such as smoking or engaging in high-risk activities can impact the cost of term life insurance.

Is a medical exam necessary to determine the quote for term life insurance?

In some cases, a medical exam might be required by insurance providers to assess the applicant's health status and determine the quote.