Exploring the world of homeowners insurance quotes, this introduction sets the stage for a deep dive into the importance, factors, and understanding of this crucial aspect of home ownership. With a blend of informative insights and practical advice, readers are in for a treat as they discover the intricacies of securing the right coverage for their homes.

Moving forward, let's unravel the complexities surrounding homeowners insurance quotes and shed light on key considerations that can impact your decision-making process.

Importance of Homeowners Insurance Quote

When it comes to protecting your most valuable asset, your home, getting a homeowners insurance quote is crucial. It provides you with an estimate of the cost to insure your property and belongings, helping you plan and budget for unexpected events.

Benefits of Comparing Multiple Homeowners Insurance Quotes

Comparing multiple homeowners insurance quotes allows you to find the best coverage at the most competitive price. By exploring different options, you can ensure that you are getting the most value for your money and tailor the policy to meet your specific needs.

- Save Money: By comparing quotes, you can identify cost-effective policies that offer the coverage you require without overspending.

- Tailored Coverage: Different insurance providers offer various coverage options, allowing you to customize your policy to suit your home and possessions.

- Quality Service: Researching and comparing quotes enables you to choose an insurance provider with a solid reputation for customer service and claims handling.

Examples of Situations Where Having a Homeowners Insurance Quote is Crucial

Having a homeowners insurance quote ready can make a significant difference in various scenarios, such as:

- Before Purchasing a Home: Understanding the insurance costs associated with a potential home purchase can influence your decision and budgeting.

- After Natural Disasters: In the unfortunate event of a natural disaster damaging your home, having an insurance quote helps expedite the claims process.

- When Renewing Policies: Periodically comparing quotes ensures you are not overpaying for insurance and have the most up-to-date coverage.

Factors Influencing Homeowners Insurance Quotes

When it comes to homeowners insurance quotes, several key factors come into play that can impact the cost of your policy. Understanding these factors is crucial in determining the price you pay for coverage.Location plays a significant role in determining homeowners insurance quotes.

Areas prone to natural disasters such as hurricanes, earthquakes, or wildfires typically have higher insurance premiums. Additionally, the crime rate in your neighborhood can also affect your quote.The value of your home is another important factor that insurance companies consider when providing a quote.

More expensive homes will generally have higher insurance premiums since they cost more to repair or replace in case of damage.Coverage limits and deductible amounts also play a crucial role in determining your homeowners insurance quote. Higher coverage limits and lower deductibles will result in higher premiums, while lower coverage limits and higher deductibles will lead to lower premiums.Personal factors such as credit score and claims history can also influence insurance quotes.

Insurance companies may offer lower rates to individuals with a good credit score and no history of frequent insurance claims, as they are considered lower risk.

Comparison of Factors

- Location: Areas prone to natural disasters or with high crime rates can lead to higher insurance premiums.

- Home Value: More expensive homes will generally have higher insurance premiums.

- Coverage Limits and Deductibles: Higher coverage limits and lower deductibles result in higher premiums, while lower coverage limits and higher deductibles lead to lower premiums.

- Personal Factors: Credit score and claims history can influence insurance quotes, with lower rates offered to individuals with a good credit score and no history of frequent claims.

Understanding Homeowners Insurance Coverage

When it comes to homeowners insurance, understanding the coverage included in your policy is crucial. It can help you make informed decisions, protect your home, and ensure you have the right level of protection in case of unexpected events.

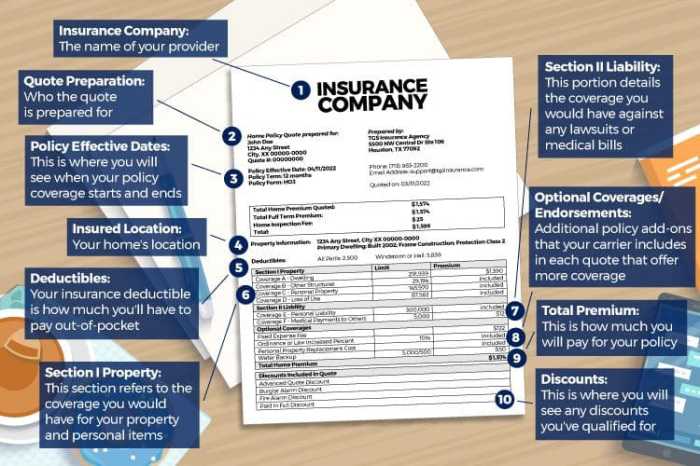

Types of Coverage in a Standard Homeowners Insurance Policy

- Dwelling Coverage: This covers the structure of your home, including the walls, roof, and foundation, in case of damage from covered perils like fire, wind, or hail.

- Personal Property Coverage: This protects your belongings inside your home, such as furniture, clothing, and electronics, from covered risks like theft or vandalism.

- Liability Coverage: This provides financial protection if someone is injured on your property and decides to sue you for damages.

- Additional Living Expenses Coverage: In case your home becomes uninhabitable due to a covered event, this coverage helps pay for temporary living arrangements.

What is Covered and Not Covered by Homeowners Insurance

- Covered: Damage from fire, theft, vandalism, windstorms, and some natural disasters like lightning or hail.

- Not Covered: Damage from floods, earthquakes, poor maintenance, and normal wear and tear are usually not covered by standard homeowners insurance.

Importance of Understanding Coverage Limits and Exclusions

It's essential to know the limits of your coverage to avoid surprises when making a claim. Understanding exclusions helps you identify areas where you might need additional coverage, such as flood insurance or earthquake insurance. Being aware of what your policy covers and excludes can help you tailor your coverage to your specific needs and ensure you are adequately protected.

Obtaining and Comparing Homeowners Insurance Quotes

When looking for homeowners insurance, it is essential to obtain and compare quotes from different providers to ensure you get the best coverage at the most competitive price. This process involves requesting quotes from various insurance companies and carefully analyzing the details to make an informed decision.

Process of Obtaining Homeowners Insurance Quotes

Before you start comparing quotes, you need to gather some basic information about your home, such as its age, size, construction materials, and any security features it may have. You can then reach out to different insurance companies or use online platforms to request quotes based on this information.

- Fill out online quote forms on insurance company websites.

- Contact insurance agents directly to request quotes.

- Provide accurate information about your home to get precise quotes.

Accurately Comparing Quotes for Adequate Coverage

When comparing homeowners insurance quotes, it's crucial to look beyond the price and consider the coverage and limits offered by each policy. Here are some tips to help you compare quotes accurately:

- Compare coverage limits for dwelling, personal property, liability, and additional living expenses.

- Review deductibles and understand how they affect your premium and out-of-pocket costs.

- Check for any exclusions or limitations in coverage that may impact your decision.

Tips for Negotiating with Insurance Companies

Once you have obtained quotes from different providers, you can use this information to negotiate with insurance companies for better rates or coverage options. Here are some tips for negotiating based on the obtained quotes:

- Highlight any lower quotes you received from other companies to see if they can match or beat the price.

- Ask about discounts or bundling options that could help lower your premium.

- Inquire about any additional coverage options that may be beneficial for your specific needs.

Outcome Summary

As we conclude our exploration of homeowners insurance quotes, it becomes evident that being well-informed and proactive in securing the right coverage is paramount for homeowners. By understanding the nuances of insurance quotes and delving into the intricacies of coverage options, individuals can make informed decisions that protect their homes and loved ones.

Key Questions Answered

What factors can influence homeowners insurance quotes?

Factors such as location, home value, coverage limits, deductible, credit score, and claims history can all impact homeowners insurance quotes.

Why is it important to compare multiple homeowners insurance quotes?

Comparing quotes allows you to find the best coverage at the most competitive price, ensuring you get adequate protection for your home.

What are some examples of situations where having a homeowners insurance quote is crucial?

Situations like natural disasters, accidents, or theft highlight the importance of having homeowners insurance to protect your investment.