Delve into the realm of cheap homeowners insurance as we unravel key insights and tips in a language that is both informative and engaging. Prepare to embark on a journey filled with valuable information tailored to guide you towards cost-effective coverage options.

Explore the intricacies of homeowners insurance, from understanding its basics to discovering ways to secure the best deals that suit your needs and budget.

Understanding Cheap Homeowners Insurance

When it comes to homeowners insurance, finding an affordable option is crucial for protecting your home and belongings without breaking the bank. Cheap homeowners insurance refers to policies that offer adequate coverage at a lower cost compared to other options in the market.Factors that influence the cost of homeowners insurance include the location of your home, the age and condition of the property, the coverage limits you choose, your credit score, and any additional endorsements or riders you add to the policy.

By understanding these factors, you can make informed decisions to potentially lower your insurance premiums.Having homeowners insurance is important because it provides financial protection in case of unforeseen events such as natural disasters, theft, or accidents that damage your home or belongings.

Without insurance, you would be responsible for covering the full cost of repairs or replacements, which can be financially devastating. It offers peace of mind knowing that you have a safety net in place to help you recover from unexpected events.

Tips for Finding Affordable Homeowners Insurance

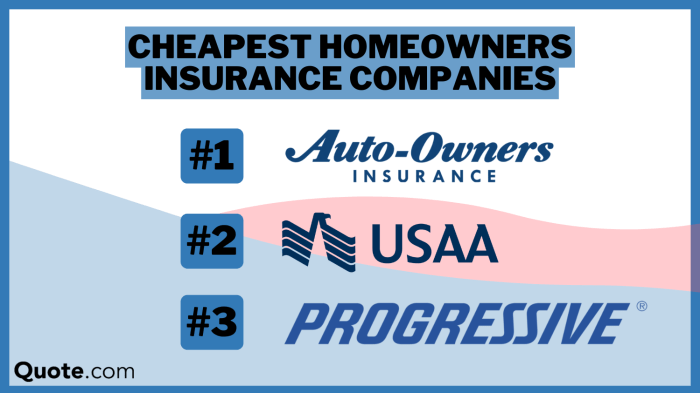

When it comes to finding affordable homeowners insurance, there are several strategies you can use to lower your premiums and ensure you are getting the best deal possible. It's important to compare quotes from different insurance companies to find the most cost-effective option that meets your needs.

Here are some tips to help you find cheap homeowners insurance:

Shop Around for the Best Rates

- Obtain quotes from multiple insurance companies to compare prices and coverage options.

- Consider working with an independent insurance agent who can help you explore different policies.

- Look for discounts that may be available based on factors like bundling policies or having a home security system.

Review and Adjust Your Coverage

- Assess your current coverage needs and adjust your policy accordingly to avoid over-insuring your home.

- Consider increasing your deductible to lower your premiums, but make sure you can afford the out-of-pocket costs in case of a claim.

- Remove unnecessary coverages or riders that may be increasing your premium without providing significant benefits.

Maintain a Good Credit Score

- Improving your credit score can help lower your homeowners insurance premiums, as insurers often use credit history as a factor in determining rates.

- Pay bills on time, keep credit card balances low, and monitor your credit report for any errors that could be negatively impacting your score.

- Consider contacting your insurance company to see if they offer discounts for policyholders with good credit.

Coverage Options in Cheap Homeowners Insurance

When it comes to cheap homeowners insurance, it's important to understand the coverage options available to protect your home and belongings. Here, we will discuss the common coverage options included in affordable homeowners insurance, the difference between basic coverage and additional coverage options, and how to determine the right amount of coverage for your home.

Common Coverage Options

- Dwelling coverage: This covers the structure of your home in case of damage from covered perils like fire, wind, or vandalism.

- Personal property coverage: Protects your belongings inside your home, such as furniture, electronics, and clothing.

- Liability coverage: Offers financial protection if someone is injured on your property and sues you for damages.

- Additional living expenses coverage: Helps cover costs if you need to temporarily move out of your home due to a covered loss.

Basic vs. Additional Coverage Options

- Basic coverage typically includes dwelling, personal property, and liability coverage, while additional coverage options can be added for specific risks like floods, earthquakes, or valuable items like jewelry.

- Additional coverage options come with higher premiums but provide more comprehensive protection for your home and belongings.

- It's essential to assess your needs and risks to determine if you need to add any extra coverage options to your policy.

Determining the Right Amount of Coverage

- Consider the value of your home and belongings to determine the appropriate amount of dwelling and personal property coverage.

- Factor in the cost of rebuilding your home and replacing your belongings in case of a total loss.

- Review your policy annually to make sure your coverage limits are still adequate based on changes in the value of your home and belongings.

Factors Affecting Homeowners Insurance Costs

When it comes to homeowners insurance, several factors can influence the cost of your premium. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.Location plays a significant role in determining homeowners insurance premiums. Homes located in areas prone to natural disasters such as hurricanes, earthquakes, or floods typically have higher insurance costs due to the increased risk of damage.

Additionally, the crime rate in your neighborhood can also impact your insurance rates.

Impact of Location on Insurance Premiums

The location of your home is a key factor that insurance companies consider when calculating your premium. Homes in high-risk areas are more likely to experience damage from natural disasters or theft, leading to higher insurance costs. Insurance companies take into account the proximity to fire stations, the quality of local emergency services, and historical weather patterns when determining premiums.

Home Safety Features and Insurance Costs

Installing safety features in your home can help reduce the risk of accidents or damage, which can lead to lower insurance premiums. Features such as smoke alarms, security systems, deadbolt locks, and fire extinguishers demonstrate to insurance companies that you are taking steps to protect your home and belongings.

In turn, this can result in discounts on your insurance policy.By understanding how factors like location and home safety features impact homeowners insurance costs, you can take proactive steps to potentially lower your premium and protect your investment.

Outcome Summary

As we draw the curtains on our discussion about cheap homeowners insurance, remember to apply the knowledge gained to make informed decisions and safeguard your property effectively. The path to affordable coverage lies in your hands, equipped with newfound wisdom and strategies.

Commonly Asked Questions

What factors influence the cost of homeowners insurance?

The cost of homeowners insurance can be influenced by factors such as the location of your home, the age and condition of your house, your claims history, and the coverage options you choose.

How can I lower my homeowners insurance premiums?

You can lower your homeowners insurance premiums by increasing your deductible, bundling your home and auto insurance, improving home security measures, and maintaining a good credit score.

What are common coverage options in affordable homeowners insurance?

Common coverage options in affordable homeowners insurance include dwelling coverage, personal property coverage, liability protection, and additional living expenses coverage.