Short term health insurance quotes pave the way for a deep dive into the realm of insurance, offering readers a comprehensive understanding of the intricacies involved. This guide aims to shed light on the nuances of securing the best quotes while navigating through the maze of options available.

Overview of Short Term Health Insurance Quotes

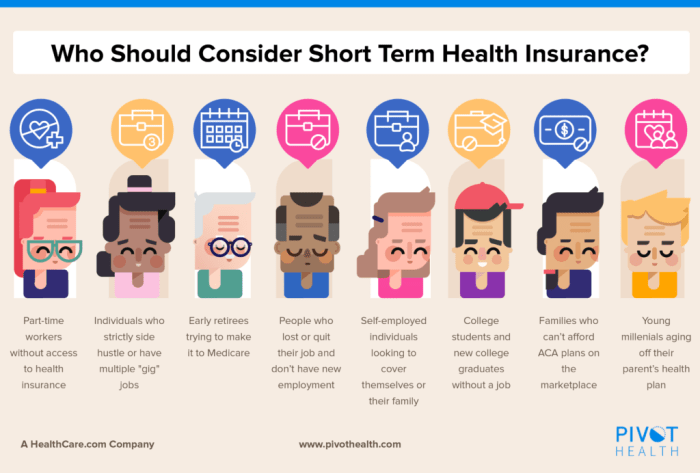

Short term health insurance is a type of health coverage that provides temporary benefits for a specific period, usually ranging from a few months to a year. It is ideal for individuals who are in between jobs, waiting for employer coverage to start, or looking for an affordable option outside of open enrollment periods.Getting insurance quotes for short term health coverage is essential to compare different plans, prices, and coverage options available in the market.

By obtaining multiple quotes, individuals can make an informed decision based on their specific needs and budget.

How Short Term Health Insurance Quotes Differ

Short term health insurance quotes differ from other types of health insurance in terms of coverage duration and flexibility. Unlike traditional health plans, short term insurance offers limited coverage for a temporary period, making it a cost-effective solution for short-term gaps in coverage.

- Short term health insurance plans typically do not cover pre-existing conditions or essential health benefits required by the Affordable Care Act.

- These plans may have lower premiums but come with higher out-of-pocket costs and limited benefits compared to comprehensive health insurance.

- Short term plans offer flexibility in terms of coverage duration, allowing individuals to choose plans that fit their specific needs and budget for a limited period.

Benefits of Comparing Multiple Quotes

Comparing multiple short term health insurance quotes before making a decision offers several advantages, including:

- Identifying the most cost-effective plan that meets your coverage needs.

- Evaluating the benefits and limitations of each plan to make an informed choice.

- Understanding the differences in premiums, deductibles, and out-of-pocket costs among various insurance providers.

- Finding personalized coverage options tailored to your specific health requirements and financial situation.

Factors Affecting Short Term Health Insurance Quotes

When it comes to short term health insurance quotes, several factors come into play that can impact the cost and coverage options available to individuals. Understanding these factors is essential for making informed decisions about your health insurance needs.

Age and Health History

Age and health history are significant factors that influence short term health insurance quotes. Younger individuals with a clean bill of health typically receive lower quotes compared to older individuals or those with pre-existing conditions. Insurance providers assess the risk associated with insuring an individual based on these factors.

- Younger individuals generally have fewer health issues and are considered lower risk, resulting in lower insurance quotes.

- Individuals with pre-existing conditions or a history of health problems may face higher quotes due to the increased likelihood of needing medical care.

Coverage Options and Deductibles

The coverage options and deductibles you choose can also impact short term health insurance quotes. Higher coverage limits and lower deductibles typically result in higher quotes, while lower coverage limits and higher deductibles can lead to more affordable quotes. It's essential to strike a balance between coverage and cost that meets your specific healthcare needs.

- Comprehensive coverage plans with lower deductibles may offer more extensive benefits but come with higher premiums.

- High-deductible plans with limited coverage can be more budget-friendly but may require you to pay more out-of-pocket for medical expenses.

Comparing Quotes from Different Providers

When exploring short term health insurance options, it's crucial to compare quotes from different providers based on coverage and cost. Each insurance company has its pricing structure and coverage options, so obtaining quotes from multiple sources allows you to evaluate the best value for your needs.

- Compare the coverage limits, deductibles, co-pays, and exclusions of each plan to determine which aligns best with your healthcare requirements.

- Consider the reputation and customer service of each insurance provider, in addition to the cost, to ensure you receive quality care and support when needed.

How to Obtain Short Term Health Insurance Quotes

To get short term health insurance quotes, follow these steps to ensure you find the best coverage at a competitive price.

Requesting Quotes Online

- Visit reputable insurance websites that offer short term health insurance.

- Fill out the online form with accurate personal information, including age, gender, and any pre-existing conditions.

- Submit the form to receive instant quotes from multiple insurance providers.

Information Needed for Accurate Quotes

- Provide details about your medical history, current health status, and any specific coverage requirements.

- Be prepared to disclose any medications you are currently taking or treatments you are undergoing.

- Include information about your desired coverage period and coverage limits.

Customizing Quotes Based on Individual Needs

- Review the quotes you receive and compare coverage options and premiums.

- Consider adding or removing specific coverage elements to customize the quote to your needs.

- Consult with insurance agents or representatives to discuss any questions or concerns about the coverage.

Evaluating and Choosing the Best Quote

- Consider the overall cost of the policy, including premiums, deductibles, and out-of-pocket expenses.

- Review the coverage details, including in-network providers, prescription drug coverage, and preventive care benefits.

- Check for any exclusions or limitations in the policy that may affect your healthcare needs.

Understanding Coverage in Short Term Health Insurance Quotes

When exploring short term health insurance quotes, it is crucial to understand the coverage included in these plans to make an informed decision. Here we will delve into the typical coverage, limitations, and exclusions, as well as the importance of reading the fine print.

Typical Coverage Included in Short Term Health Insurance Plans

Short term health insurance plans usually cover essential medical services such as doctor visits, emergency care, hospitalization, and prescription drugs. These plans are designed to provide temporary coverage for unexpected illnesses or injuries.

- Doctor Visits

- Emergency Care

- Hospitalization

- Prescription Drugs

Limitations and Exclusions of Short Term Health Insurance Coverage

It's essential to be aware that short term health insurance plans may have limitations and exclusions. These could include pre-existing conditions, maternity care, mental health services, and preventive care. Make sure to review the policy details carefully to understand what is not covered.

- Pre-existing Conditions

- Maternity Care

- Mental Health Services

- Preventive Care

Importance of Reading the Fine Print in Insurance Quotes

Reading the fine print in insurance quotes is crucial to fully comprehend the coverage, exclusions, and limitations of the plan. Pay attention to details such as coverage amounts, deductibles, copayments, and any additional costs that may apply.

Always read the fine print to avoid any surprises when it comes to your coverage.

Common Coverage Options and Add-Ons

Some short term health insurance plans may offer additional coverage options or add-ons for an extra cost. These could include dental and vision coverage, coverage for specific illnesses, or telemedicine services. Consider your individual needs when deciding on these add-ons.

- Dental and Vision Coverage

- Specific Illness Coverage

- Telemedicine Services

Final Thoughts

In conclusion, short term health insurance quotes serve as the gateway to safeguarding your health and financial well-being. By understanding the factors, obtaining quotes wisely, and grasping the coverage nuances, you can make informed decisions that cater to your individual needs.

Frequently Asked Questions

What is short term health insurance?

Short term health insurance provides temporary coverage for specific periods, typically ranging from a few months to a year.

How do age and health history impact insurance quotes?

Age and health history can influence insurance quotes as older individuals or those with pre-existing conditions may face higher premiums.

What information is needed to get accurate quotes?

To obtain precise quotes, details such as age, medical history, desired coverage, and deductible preferences are essential.

Why is it important to read the fine print in insurance quotes?

Reading the fine print helps in understanding the coverage limitations, exclusions, and any additional costs associated with the policy.

How can one customize quotes based on individual needs?

By selecting specific coverage options, adjusting deductibles, and exploring add-ons, individuals can tailor quotes to match their unique requirements.