Exploring the world of life insurance quotes opens up a realm of possibilities for securing your future and protecting your loved ones. From understanding the basics to comparing different types, this guide delves deep into the intricacies of life insurance quotes and how they can benefit you.

As we dive into the details, you'll gain valuable insights on how to navigate the complex landscape of life insurance quotes with confidence and clarity.

What is a Life Insurance Quote?

A life insurance quote is an estimate of the cost of a life insurance policy based on various factors such as age, health, lifestyle, coverage amount, and term length.

Life insurance quotes are calculated by insurance companies using actuarial tables and risk assessment algorithms to determine the likelihood of the insured individual making a claim.

Importance of Obtaining a Life Insurance Quote

Obtaining a life insurance quote is crucial to understanding the financial protection that a policy can offer to your loved ones in the event of your passing.

- It helps you compare different policies and prices from various insurance providers to find the most suitable coverage for your needs.

- By obtaining multiple quotes, you can ensure that you are getting the best value for the coverage you require.

- Life insurance quotes also allow you to assess your budget and determine the affordability of the premiums.

Types of Life Insurance Quotes

When it comes to life insurance, there are several types of quotes available to meet different needs and preferences. Each type offers unique features and benefits, making it important to understand the differences between them before making a decision.

Term Life Insurance

- Provides coverage for a specific term, such as 10, 20, or 30 years.

- Lower premiums compared to other types of life insurance.

- Best suited for individuals looking for temporary coverage.

Whole Life Insurance

- Offers coverage for the entire lifetime of the insured.

- Builds cash value over time that can be borrowed against.

- Higher premiums but guarantees a death benefit.

Universal Life Insurance

- Flexible premiums and death benefits.

- Allows for adjustments in coverage and premium payments.

- Combines a death benefit with a savings component.

Variable Life Insurance

- Allows the policyholder to allocate premiums among investment options.

- Cash value and death benefit can fluctuate based on investment performance.

- Offers the potential for higher returns but comes with investment risks.

Final Expense Insurance

- Designed to cover funeral and burial expenses.

- Lower coverage amounts with simplified underwriting process.

- Best suited for seniors looking for affordable end-of-life coverage.

Factors Affecting Life Insurance Quotes

When insurance companies calculate life insurance quotes, they take into account several factors that can significantly impact the cost of the policy. Understanding these factors and knowing how to improve them can help individuals secure better rates on their life insurance coverage.

Age

Age is a crucial factor in determining life insurance quotes. Younger individuals generally receive lower premiums as they are considered lower risk compared to older individuals. As age increases, the risk of developing health issues also rises, leading to higher premiums.

Health

Health plays a vital role in determining life insurance quotes. Insurance companies assess an individual's health through medical exams, family history, and lifestyle factors. Those with pre-existing health conditions or unhealthy habits may face higher premiums due to the increased risk of early mortality.

Lifestyle

Lifestyle choices such as smoking, excessive drinking, or engaging in high-risk activities can raise life insurance quotes. Insurers view these habits as potential threats to longevity, resulting in higher premiums to offset the added risk.

Coverage Amount

The coverage amount selected also impacts life insurance quotes. Higher coverage amounts mean the insurer is exposed to a greater financial risk, leading to higher premiums. Individuals should choose a coverage amount that meets their needs without overpaying for unnecessary coverage.

Strategies for Improving Factors

To improve factors that may lower life insurance quotes, individuals can take proactive steps such as maintaining a healthy lifestyle, quitting smoking, limiting alcohol consumption, and undergoing regular medical check-ups. By demonstrating a commitment to their health and well-being, individuals can potentially secure lower premiums on their life insurance coverage.

How to Obtain a Life Insurance Quote

Obtaining a life insurance quote is a crucial step in securing financial protection for your loved ones. Here are the steps involved in getting a life insurance quote and tips for comparing different quotes.

Requesting a Life Insurance Quote

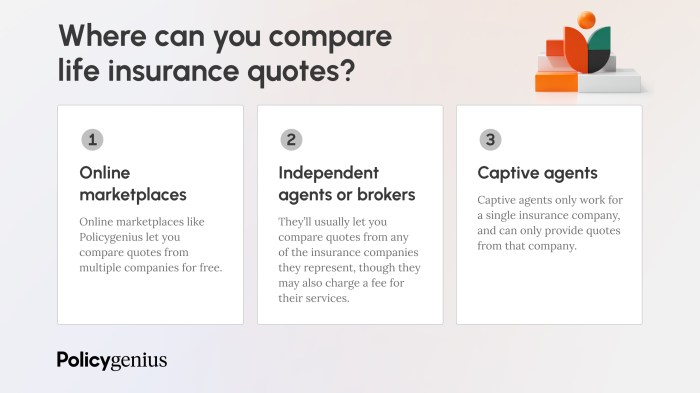

- Research Different Insurance Providers: Start by researching reputable insurance companies that offer life insurance policies.

- Contact Insurance Companies: Reach out to the insurance companies either through their website, over the phone, or in person to request a life insurance quote.

- Provide Necessary Information: Be prepared to provide personal information such as age, gender, health history, lifestyle habits, and desired coverage amount.

- Select Policy Options: Choose the type of life insurance policy that best fits your needs, whether it's term life, whole life, or universal life insurance.

- Review the Quote: Carefully review the details of the life insurance quote, including premiums, coverage amount, and any additional benefits or riders.

Comparing and Evaluating Quotes

- Compare Premiums: Look at the premium amounts for each life insurance quote and consider how they fit into your budget.

- Check Coverage Amounts: Ensure that the coverage amount offered by each quote meets your financial obligations and long-term goals.

- Consider Additional Benefits: Take into account any additional benefits or riders included in the life insurance policy and how they add value to your coverage.

- Read Reviews: Look up customer reviews and ratings for the insurance companies to get an idea of their reputation and customer service.

- Consult with an Insurance Agent: If you have any questions or need clarification on the life insurance quote, don't hesitate to speak with an insurance agent for guidance.

Last Recap

In conclusion, life insurance quotes serve as a crucial tool in safeguarding your financial well-being and providing peace of mind for the future. By understanding the various types, factors, and steps involved, you can make informed decisions that align with your needs and goals.

Take charge of your financial security today with the right life insurance quote.

FAQ Corner

What factors can impact the cost of a life insurance quote?

Factors such as age, health condition, lifestyle choices, and coverage amount can all influence the final cost of a life insurance quote.

How can I improve factors that may lower life insurance quotes?

You can improve factors like maintaining a healthy lifestyle, regular health check-ups, and opting for lower coverage amounts to potentially lower your life insurance quotes.

What types of life insurance quotes are available?

There are various types including term life, whole life, and universal life insurance quotes, each offering unique features and benefits.